Your money. Grow, protect and enjoy more of it.

A blog about financial planning by Andrew Jennings. Andrew has worked in insurance since 2003; you'll find information on insurance for individuals and businesses, such as life and critical illness insurance, trusts, business protection (key person insurance, shareholder protection, liability insurance) amongst other things

Tuesday, 27 October 2015

What happens at a business protection review?

Labels:

business protection,

financial advice,

key person insurance,

liability insurance,

life insurance,

relevant life insurance,

shareholder protection

St Ives, Cambridgshire, UK

Saint Ives, Cambridgeshire PE27 5BH, UK

Tuesday, 4 August 2015

The catastrophic impact of a debilitating illness

I recommend you spend 6 minutes of your time today to watch this video, made by +7families, a charity-led campaign.

This couple have lived this ordeal since 2012. One bit of luck they had was that 7 Families chose to support them financially by donating the money they would have received had they insured against such a problem.

No matter whether you are just starting out in your first job, buying a home, having a family, or if your children have flown the nest, if you haven't yet seriously considered protecting you and your family against the financial meltdown of not being able to work, ask your financial adviser to talk to you about this.

This couple have lived this ordeal since 2012. One bit of luck they had was that 7 Families chose to support them financially by donating the money they would have received had they insured against such a problem.

[7 Families] aim to highlight the need for people to plan financially in case they become too ill to earn an income and the charity Disability Rights UK are working with seven families where the main breadwinner has been forced out of work by an accident or illness and not received any related insurance pay out.We live in a country where more people insure their pets than themselves. Yet the impact of losing your income can be disastrously higher than paying a vet's bill.

No matter whether you are just starting out in your first job, buying a home, having a family, or if your children have flown the nest, if you haven't yet seriously considered protecting you and your family against the financial meltdown of not being able to work, ask your financial adviser to talk to you about this.

Labels:

7 Families campaign,

Accident protection,

critical illness,

disability insurance,

financial advice,

financial advisor,

Income Protection,

life insurance,

protection,

Work

St Ives, Cambridgshire, UK

Saint Ives, Saint Ives, Cambridgeshire PE27 5BH, UK

Tuesday, 28 April 2015

Ever broken a bone, or been hospitalised?

If you've been unfortunate enough to have broken a bone, or have been hospitalised, you'll no doubt know how disruptive and costly it can be, not to mention painful.

Time off work recuperating, family travelling to see you in hospital, paying for taxis whilst unable to drive for several weeks or even months; all these things can hit your pocket, and whilst the problem might only be a temporary one, it can hit hard on your emergency fund or credit card.

Time off work recuperating, family travelling to see you in hospital, paying for taxis whilst unable to drive for several weeks or even months; all these things can hit your pocket, and whilst the problem might only be a temporary one, it can hit hard on your emergency fund or credit card.

One solution to easing the financial pain could be an accident protection plan.

These plans are designed to give financial support when you suffer accidental broken bones, hospitalisation, accidental permanent injuries or disablement and accidental death.

You may well be thinking "it won't happen to me", and hopefully it never will, but these plans can be particularly useful for people who take part in higher risk activities such as equestrianism, extreme and winter sports, biking, contact sports such as rugby and martial arts. Almost everyone partaking in these activities will have suffered or know someone who has suffered an injury requiring hospitalisation, or has broken some bones.

If those people knew they might have received several thousand pounds per broken bone plus several hundred pounds for each 24 hour period spent in hospital, they would no doubt have considered insurance to protect themselves financially against such an accident.

If those people knew they might have received several thousand pounds per broken bone plus several hundred pounds for each 24 hour period spent in hospital, they would no doubt have considered insurance to protect themselves financially against such an accident.

Many people are in the fortunate position of knowing about and being able to take out accident protection plans before such an event happens.

Such plans can cost less than £40/month, and are even accessible to many people who might not qualify for other forms of insurance such as income protection, due to pre-existing medical conditions. Even better for some, is that pre-existing medical conditions aren't rated (which could otherwise result in expensive premiums), nor is smoking, nor age, nor is taking part in hazardous activities such as those above (as long as you aren't a professional sportsperson).

So, if you think there is a chance that you may break a bone or be hospitalised, or if you have been declined insurance or found it too expensive due to age or lifestyle, ask your financial adviser for some information on accident protection - it could be one of the best financial decisions you make.

So, if you think there is a chance that you may break a bone or be hospitalised, or if you have been declined insurance or found it too expensive due to age or lifestyle, ask your financial adviser for some information on accident protection - it could be one of the best financial decisions you make.

Time off work recuperating, family travelling to see you in hospital, paying for taxis whilst unable to drive for several weeks or even months; all these things can hit your pocket, and whilst the problem might only be a temporary one, it can hit hard on your emergency fund or credit card.

Time off work recuperating, family travelling to see you in hospital, paying for taxis whilst unable to drive for several weeks or even months; all these things can hit your pocket, and whilst the problem might only be a temporary one, it can hit hard on your emergency fund or credit card.One solution to easing the financial pain could be an accident protection plan.

These plans are designed to give financial support when you suffer accidental broken bones, hospitalisation, accidental permanent injuries or disablement and accidental death.

You may well be thinking "it won't happen to me", and hopefully it never will, but these plans can be particularly useful for people who take part in higher risk activities such as equestrianism, extreme and winter sports, biking, contact sports such as rugby and martial arts. Almost everyone partaking in these activities will have suffered or know someone who has suffered an injury requiring hospitalisation, or has broken some bones.

If those people knew they might have received several thousand pounds per broken bone plus several hundred pounds for each 24 hour period spent in hospital, they would no doubt have considered insurance to protect themselves financially against such an accident.

If those people knew they might have received several thousand pounds per broken bone plus several hundred pounds for each 24 hour period spent in hospital, they would no doubt have considered insurance to protect themselves financially against such an accident.Many people are in the fortunate position of knowing about and being able to take out accident protection plans before such an event happens.

Such plans can cost less than £40/month, and are even accessible to many people who might not qualify for other forms of insurance such as income protection, due to pre-existing medical conditions. Even better for some, is that pre-existing medical conditions aren't rated (which could otherwise result in expensive premiums), nor is smoking, nor age, nor is taking part in hazardous activities such as those above (as long as you aren't a professional sportsperson).

So, if you think there is a chance that you may break a bone or be hospitalised, or if you have been declined insurance or found it too expensive due to age or lifestyle, ask your financial adviser for some information on accident protection - it could be one of the best financial decisions you make.

So, if you think there is a chance that you may break a bone or be hospitalised, or if you have been declined insurance or found it too expensive due to age or lifestyle, ask your financial adviser for some information on accident protection - it could be one of the best financial decisions you make.

Labels:

Accident protection,

bmxing,

broken bones,

cycling,

horse-riding,

hospitalisation,

injury,

insurance for injuries,

MetLife,

mountain biking,

road racing,

rugby,

skateboarding,

skiing,

snowboarding

St Ives, Cambridgshire, UK

Cambridgeshire, UK

Thursday, 14 August 2014

Protect the future of your business

Labels:

business protection,

critical illness,

financial advice,

financial advisor,

Infographic,

key person insurance,

liability insurance,

life insurance,

shareholder protection

St Ives, Cambridgshire, UK

Cambridgeshire PE27, UK

Tuesday, 10 June 2014

A funny place to be asked a question about insurance.

Last week I was asked a question atop a 160ft gantry at Magna Science Adventure Centre seconds before doing a bungee jump.

Part of the Jumpmaster's job is to calm the jumpers' nerves as best he can, by keeping them thinking. Whilst my ankle straps were being attached to the bungee rope (no matter how expert they are, you can't help but think you need to double-check they are doing their job properly!), he asked, "So what do you do for a living?"

"I sell life insurance", I replied, peering over the gantry edge at drop beneath. The Jumpmaster and his crew member found this a lot funnier than I did, at the time.

He then asked a question I've been asked several times before, but usually in much less unusual situations than this, "What's the difference between insurance and assurance?"

I explained that the two terms refer to different things but are often used incorrectly. Insurance describes a policy which has a fixed term, and MIGHT pay out. Assurance usually has no fixed term and WILL pay out when a certain event happens.

Think about annual travel INSURANCE. You pay for a year's cover, but you hope you won't have to claim on it. In the same sense, a life INSURANCE policy to protect your home whilst you pay off a mortgage, for example, lasts until the mortgage is paid off. It is designed to pay out IF you die before the end of the policy. However, we all hope to outlive our mortgage!

A life ASSURANCE policy is designed to pay out WHEN you die, not IF. These are often called whole of life plans, as opposed to term insurance policies. They often have a cash value attached to them as well, which a term policy doesn't.

Anyway, the bungee rope was attached properly, and my life INSURANCE policy continues on towards the end of its term.

Part of the Jumpmaster's job is to calm the jumpers' nerves as best he can, by keeping them thinking. Whilst my ankle straps were being attached to the bungee rope (no matter how expert they are, you can't help but think you need to double-check they are doing their job properly!), he asked, "So what do you do for a living?"

"I sell life insurance", I replied, peering over the gantry edge at drop beneath. The Jumpmaster and his crew member found this a lot funnier than I did, at the time.

He then asked a question I've been asked several times before, but usually in much less unusual situations than this, "What's the difference between insurance and assurance?"

I explained that the two terms refer to different things but are often used incorrectly. Insurance describes a policy which has a fixed term, and MIGHT pay out. Assurance usually has no fixed term and WILL pay out when a certain event happens.

Think about annual travel INSURANCE. You pay for a year's cover, but you hope you won't have to claim on it. In the same sense, a life INSURANCE policy to protect your home whilst you pay off a mortgage, for example, lasts until the mortgage is paid off. It is designed to pay out IF you die before the end of the policy. However, we all hope to outlive our mortgage!

A life ASSURANCE policy is designed to pay out WHEN you die, not IF. These are often called whole of life plans, as opposed to term insurance policies. They often have a cash value attached to them as well, which a term policy doesn't.

Anyway, the bungee rope was attached properly, and my life INSURANCE policy continues on towards the end of its term.

Labels:

financial advisor,

life assurance,

life insurance,

protection

St Ives, Cambridgshire, UK

Cambridgeshire PE27, UK

Thursday, 17 April 2014

Self-employed face protection ‘gap’ risk

An increasing number of people have become self-employed in recent years. If you are among them, you may have found the switch has left you without the employment benefits you previously took for granted.

Between 2008 and 2012, the number of people whose main job

was self-employed rose by 367,000. Sixty per cent of this increase occurred between

2011 and 2012 – a possible result of the recession. The number of

self-employed people in the UK

now stands at 4.37 million, representing 14.5% of the working population.

Making the change from being employed to self-employed is

clearly a big step – and it’s one more people are taking. But while some may

find their income rises, it can be easy to forget about replacing lost employee

benefits including sick pay and life insurance.

Lost employee benefits

Many employed people automatically benefit from life

insurance, arranged on their behalf by their employer. This would pay a

multiple of their annual salary were they to die, which could then be used to

pay off a mortgage or provide funds to support their family in the future.

They

may have also received a proportion of their salary for a period of time (that

exceeded the statutory sick pay levels) if they were unable to work due to

illness or injury, and benefitted from access to private medical treatment.

Clearly moving from employment to self-employment would mean these benefits

cease, potentially leaving a protection ‘gap’.

Plugging the protection ‘gap’

Fortunately, the insurance cover you may have benefited

from as an employee is also available to you as a self-employed individual –

and it may be more affordable than you think.

Income protection insurance will pay you a

monthly income to cover your living expenses should you be unable to work through illness

or injury, and should be considered an essential piece of protection. It can

help prevent your family suffering financial hardship, and help you recover

more quickly without the burden of financial worry. Many insurance companies

also provide support for customers to help them

return to fitness as quickly as possible.

A life and

critical illness plan will pay either a tax-free lump sum or a regular income

should you suffer a serious illness, or die, and can help secure your family’s

financial future.

Private medical insurance may be considered less of a

priority than either income protection or life insurance, given the treatment

you are entitled to from the NHS.

For those seeking to replicate all the benefits they may

have enjoyed when employed, there are a range of policies available at varying

price levels.

Are you covered?

If you are self-employed, it is easy to ensure that your

employment status doesn’t put your long-term financial security – and that of

your family – at risk.

To discuss your protection needs, speak to your financial adviser.

Labels:

critical illness,

Ewing Associates,

financial advice,

Income Protection,

life insurance,

protection,

Work

St Ives, Cambridgshire, UK

Ewing Associates, 9 Station Road, Saint Ives, Cambridgeshire PE27 5BH, UK

Wednesday, 15 January 2014

How long could you survive without your salary?

What would happen if you were off work for week? A reduced income may be paid in the form of statutory sick pay (SSP), or you might receive your full salary if your employer is generous. If you're self-employed you can't claim SSP or company sick pay from someone else.

What if you were signed off work for 3 months?

What if you were signed off work for 3 months?

How about 2 years? The remainder of your career?

Just how long could you survive financially?

These are not scare tactics - these are simple questions about which too many people don't think until it's too late.

Too late might be when you've been unable to work for 3 months, your contractual sick pay period is ending, your savings fund has run dry and you now have to survive on state benefits.

Too late might be when you approach retirement and are more likely to need time off work for health reasons.

Too late could be when you are diagnosed with a medical condition which limits the work you can do, and therefore your retirement plan has to change.

Some ways people are protected against this are : a) Having a very affluent family who could and would replace your lost income if you can't work; b) having enough cash available to pay yourself an income similar to that which you earn now; or c) by taking out an insurance policy so your household income remains at a similar level even if you have to leave your job due to illness or disability.

a) A minority of people are fortunate to be in this group, and insurance may or may not be right for them;

b) Do you have enough cash to survive until retirement?

c) This last option seems like it could be expensive, doesn't it?

Well, c) isn't necessarily expensive - it all depends on the risk of you making a claim. A 65-year old smoker working as an explosives operative with severe back problems is likely to be uninsurable.

For most people who don't work in high-risk jobs, or who aren't already suffering serious illnesses income protection is a sensible and affordable way of making sure that the household income could still be received every month.

It may surprise you to know that for a lot of people, it ought not to be a million miles away from these figures. Of course, as I mentioned earlier, the higher your risk, the less of a good deal you might find.

The irony is, as with most forms of insurance, that the more you are in need of cover, the more expensive it is likely to be. Those in their late teens/early twenties will often not see the point in spending, let's say for example, £15/month for the next 45 years, as they feel the likelihood of a claim is so low it is worth the risk. Conversely, if you were to ask people in their fifties who have had to change occupations due to health or illness if they would have taken such a policy when they were twenty, what do you think those people would say? Chances are, they would wish they had taken out such a policy earlier.

Many people think they don't need insurance until it is too late. Here is part of a famous Winston Churchill quote:

What if you were signed off work for 3 months?

What if you were signed off work for 3 months?How about 2 years? The remainder of your career?

Just how long could you survive financially?

These are not scare tactics - these are simple questions about which too many people don't think until it's too late.

Too late might be when you've been unable to work for 3 months, your contractual sick pay period is ending, your savings fund has run dry and you now have to survive on state benefits.

Too late might be when you approach retirement and are more likely to need time off work for health reasons.

Too late could be when you are diagnosed with a medical condition which limits the work you can do, and therefore your retirement plan has to change.

Protect Yourself

Some ways people are protected against this are : a) Having a very affluent family who could and would replace your lost income if you can't work; b) having enough cash available to pay yourself an income similar to that which you earn now; or c) by taking out an insurance policy so your household income remains at a similar level even if you have to leave your job due to illness or disability.

a) A minority of people are fortunate to be in this group, and insurance may or may not be right for them;

b) Do you have enough cash to survive until retirement?

c) This last option seems like it could be expensive, doesn't it?

Well, c) isn't necessarily expensive - it all depends on the risk of you making a claim. A 65-year old smoker working as an explosives operative with severe back problems is likely to be uninsurable.

For most people who don't work in high-risk jobs, or who aren't already suffering serious illnesses income protection is a sensible and affordable way of making sure that the household income could still be received every month.

What is it worth to you?

So what is that level of cover worth to you? £10/month? £25/month? £50/month. Or look at it another way - 1% of your salary? 3% of your salary?

The irony is, as with most forms of insurance, that the more you are in need of cover, the more expensive it is likely to be. Those in their late teens/early twenties will often not see the point in spending, let's say for example, £15/month for the next 45 years, as they feel the likelihood of a claim is so low it is worth the risk. Conversely, if you were to ask people in their fifties who have had to change occupations due to health or illness if they would have taken such a policy when they were twenty, what do you think those people would say? Chances are, they would wish they had taken out such a policy earlier.

Many people think they don't need insurance until it is too late. Here is part of a famous Winston Churchill quote:

"If I had my way, I would write the word "insure" upon the door of every cottage and upon the blotting book of every public man, because I am convinced, for sacrifices so small, families and estates can be protected against catastrophes which would otherwise smash them up forever"Maybe it would be sensible to speak to your financial adviser to find out what it would cost you to protect your income?

Labels:

career,

disability insurance,

Ewing Associates,

financial advice,

Income Protection,

key person insurance,

keyperson insurance,

Work

St Ives, Cambridgshire, UK

Saint Ives, Cambridgeshire, UK

Sunday, 5 January 2014

Dealing with negativity at work

Whilst this might appear slightly off-topic at first, I think this is a really useful article if you are experiencing difficulty dealing with such people, be it at work or in your personal life. It does relate to my blog's usual subject matter, as being happy at work is one thing that can have a significant impact on your financial future.

Mashable: How to Deal With Your 5 Most Negative Co-workers. http://google.com/newsstand/s/CBIwt_WD5w8

Labels:

career,

colleagues,

negativity,

Work

St Ives, Cambridgshire, UK

Huntingdonshire,

Saturday, 20 July 2013

How Well Protected Is Your Business?

To

safeguard your business you have probably secured buildings

insurance, machinery or equipment insurance and indemnity or public

liability insurance. You may have covered the tangible assets of your

business, but have you protected the most important assets: the

people that directly contribute to your profits? Are your profits

protected should you lose employees unexpectedly? How will your

business profits be protected if you or your business partner is

taken ill and can’t work?

To

safeguard your business you have probably secured buildings

insurance, machinery or equipment insurance and indemnity or public

liability insurance. You may have covered the tangible assets of your

business, but have you protected the most important assets: the

people that directly contribute to your profits? Are your profits

protected should you lose employees unexpectedly? How will your

business profits be protected if you or your business partner is

taken ill and can’t work?

If you run

your own business, you probably have one or more key employees that

are integral to its success. These are the people who possess the

skills, knowledge, experience or leadership that makes a vital

difference to your bottom line.

Does your

business have a Sales Manager with an established network of contacts

perhaps? Do you have highly skilled or technical staff? What about

you, the director or business owner? Have you

considered what would happen if they suddenly died, or suffered a

critical illness that forced them to be absent from work for a long

period of time? Have you considered the costs and time

implications associated with recruiting a locum or temporary

contractor to fill the gap? What effect will their absence have on

your business’s profits?

If the

unexpected happened before you've had a chance to protect against

such loss, your business would be at risk of collapse.

Q.

What is Key Person Insurance?

Key Person

Insurance is a simple way for businesses making a profit to insure

their business against the losses they might suffer as a result of

the death, disability or critical illness of a key individual.

Q.

My business is very small with fewer than ten staff. Do I need to be

concerned with Key Person Insurance?

Absolutely.

With a small business key people are more likely to be

responsible for a larger proportion of the company’s profits. If

the unexpected were to happen, then the impact for a small business

would be dramatic and could have huge consequences financially.

Q.

My business is larger with more Key People. What should I do?

Large

businesses should also consider Key Person Insurance. FTSE100

companies all insure their key people as part of their business

continuity plan. Even though the impact of one person no longer

coming to work wouldn’t be as financially disastrous for a very

large firm, they still consider it vital to protect their profits.

Q.

Is there any other cover I should be aware of to protect my

business?

Yes. As

part of your business continuity planning you should consider

shareholder protection and loan protection. These provide the

business with cash to buy the shares of a deceased or seriously ill

director, or repay a loan should the bank, for example, recall this

on the death of a director. Whether you are a sole trader,

partnership or a Limited Company, you must ensure that your business

has the correct financial safeguards in place.

_________________________________________________________

With

over 25 years of experience in helping people make their financial

plans, Ewing Associates build strong trusted relationships with our

clients. We offer an expert and friendly financial planning service.

Our

experience covers personal and corporate financial advice. We fully

understand the individual needs of every client and provide a first

class service.

We

will help you understand the numerous financial services available,

tailor the right solution to your specific needs and help make your

money work harder for YOU.

Ewing

Associates’ services include mortgage advice, personal and

corporate financial planning, investment advice and estate planning.

E-mail

andrew@ewingassociates.co.uk or call 01480 357100 for more

information

Labels:

business protection,

critical illness,

Ewing Associates,

FCA,

financial advice,

financial advisor,

FSA,

keyperson insurance,

life insurance,

protection

St Ives, Cambridgshire, UK

Saint Ives, Cambridgeshire PE27 5BH, UK

Wednesday, 27 March 2013

Fed up with low returns from Cash ISAs?

Cash ISA returns fell after the credit crunch, and at time of writing this you'll do well to find many which return over 3% annually.

Cash ISA returns fell after the credit crunch, and at time of writing this you'll do well to find many which return over 3% annually.

So is there a way to make your savings work harder without risking your hard-earned capital during these economically unstable times?

Read on to find out.

The basics explained.

Since the introduction of Individual Savings Accounts (ISA) in the UK in 1999, there have been, broadly speaking, two types: Cash ISAs and Stocks & Shares ISAs.

Cash ISAs are similar to a bank account, apart from the tax treatment. Interest is not subject to income tax nor capital gains tax. Your deposit is as safe as if you had deposited it in an ordinary savings account and the returns are known, at least for the current tax year.

Stocks & Shares ISAs are an investment rather than a deposit. Again, your returns have a different tax treatment than outside of an ISA, but as with other investments, your capital is at risk. So you could end up with less than you invested. However, and this is the main attraction of investments, you could end up with far more than a Cash ISA would have returned. Therefore, they are really only suitable for those who understand and are happy with these risks.

Structured deposits

So, if you aren't happy to risk your capital by investing in a Stocks & Shares ISA and you aren't happy with with the relatively low (compared to years leading up to 2009) interest rate of Cash ISAs, where is the best place to deposit your savings?

What if you were offered the security of a bank deposit account whilst also having limited exposure to underlyings such as the FTSE100 and therefore potentially higher returns than a standard deposit account or Cash ISA? This is essentially a how a Structured Deposit works.

So, you could achieve returns of 6% per annum or more, and those returns are tax free. Sound too good to be true in this day and age? There are some restrictions of course, and an element of low risk.

The risk is that you may receive back only your original deposit at the end of term. Terms usually last 3, 5 or 6 years (although some schemes have paid out, or 'kicked-out' after just 1 year), so you need to be prepared to not make any withdrawals for a number of years. So, for example, if I transferred £10,000 today into a 5-year term structured deposit, I might receive only £10,000 back in 2018 - that is the worst case scenario (assuming our banks don't go the way Cyprus's have recently). If I left that sum in my bank's Cash ISA, it would have grown to £10,050 in 2018 based on the bank's current published rates. So I'm effectively risking £50 to try and get a better return.

So what are those better returns?

Each structured product provider offers different ways of indirectly exposing your money to the markets. These offers usually only have a window of a matter of weeks before they are replaced with different terms. For example, one may be designed to return 100% of any increase in the FTSE100 over a 5 year term e.g. if the FTSE has risen by 40% over 5 years, your balance will have grown by 40%. If the FTSE has fallen by 30%, you will have lost 30%..... except you won't of course! Because you are guaranteed to receive at least your original deposit back. Even though the FTSE may be 30% below its level when you deposited your money, you don't lose any of your deposit.

To summarise, a structured deposit is deposit based and offers a defined return linked to one or more underlyings, such as the FTSE 100. Structured Deposits are designed to return at least the initial deposit by the end of the product life with any additional return linked to the movement of the underlying. Structured deposits can be held within a variety of tax wrappers such as a Cash ISA.

Where can I find out more about structured deposits?

If you are fed up with low savings and Cash ISA rates, or are just interested in finding out more about these products, have a word with your financial adviser, who should be able to help you find out if structured deposits might be the right place for some of your savings.

Labels:

cash ISA,

Ewing Associates,

financial advice,

financial advisor,

how do i get a better interest rate?,

investments,

ISA,

savings,

savings work harder,

stocks and shares ISA,

Structured deposits

St Ives, Cambridgshire, UK

Saint Ives, Cambridgeshire PE27 5BH, UK

Wednesday, 20 March 2013

Government's Help to Buy Scheme - an Infographic

Labels:

Budget 2013,

Ewing Associates,

first time buyer,

Help to Buy,

homebuyer,

house purchase,

Infographic,

mortgage,

new build

St Ives, Cambridgshire, UK

Saint Ives, Cambridgeshire PE27 5BH, UK

Wednesday, 5 December 2012

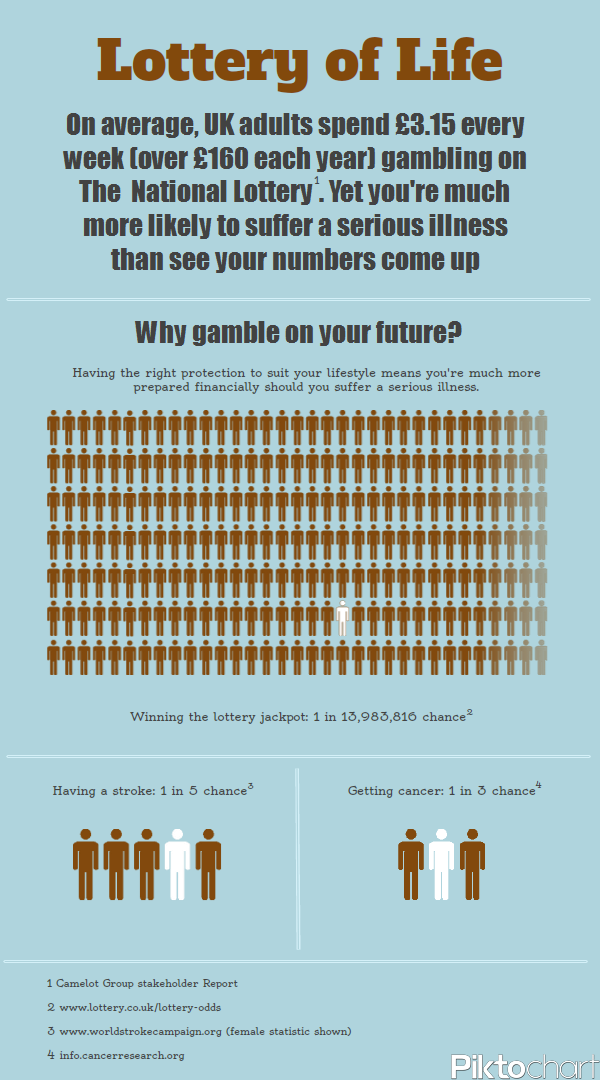

Lottery of Life

Critical Illness Insurance

What it does

Critical illness insurance pays out a tax-free lump sum on the diagnosis of certain life-threatening or debilitating (but not fatal) conditions including heat attack, stroke, cancer, and major organ transplants. This list will vary depending on the insurer, as will the exclusions for making a claim.

Critical illness often comes as an optional addition to a life insurance policy, but can also be purchased on its own. Policies usually only pay out once, so they don't necessarily replace your regular income, but you can use the money towards medical treatment, your mortgage or anything else you choose.

Why you might need it

Many people buy critical illness insurance when they take on a major commitment, like a mortgage, or start a family. However, since we'd all like to have our financial commitments lightened if we were to suffer a serious illness or injury, the cover is relevant for most of us at any time.

Replacing an existing critical illness policy

If you already have critical illness insurance you should think carefully before you cancel your existing policy and take our a new one.

For example, if you've developed any illnesses since you first took out the policy, you may lose some of the benefits when you replace it. That's because pre-existing medical conditions may not be covered by the new policy.

Recent advances in the treatment of certain conditions, such as cancer, may also have an effect, as a new policy might be more restrictive than an older policy when it comes to paying claims for certain conditions.

A good financial adviser should be able to quickly identify the issues and help you make the right decision about your critical illness insurance.

Labels:

critical illness,

Ewing Associates,

financial advice,

financial advisor,

Infographic,

protection

St Ives, Cambridgshire, UK

9 Station Rd, St Ives, Cambridgeshire PE27 5BH, UK

Tuesday, 2 October 2012

Press Release: Ewing Associates is a Business Focus exhibitor

Press Release: Ewing Associates is a Business Focus exhibitor

Ewing Associates is a Business Focus exhibitorEwing Associates has secured a stand at Business Focus, the region's premier business-to-business exhibition taking place at Peterborough Arena on Wednesday 17th October 2012.

Last year's sell-out Business Focus welcomed more than 700 visitors and exhibitors embraced the opportunity to promote their latest products and services to a targeted, receptive audience.

This year's event promises to be even bigger, and will showcase the region's success as the Business Environment Capital of the UK. Exciting new attractions include:

- The Eco House - a futuristic showhome inside the main exhibition hall

- The Secret Millionaire - retail consultancy CEO Mike Greene giving inspirational insight into a top-performing business

- Business Central - the latest innovations from selected exhibitors

- Foods of the World - the chance to refuel on sizzling cuisine from top regional caterers and suppliers

During the day, influential professional groups and organisations will be among the visitors, meeting stand-holders and talk about the business developments shaping this region. Visitors can attend the exhibition free of charge.

Sponsors of Business Focus 2012 are The Peterborough Telegraph, Peterborough Regional College, Larkfleet Group, Peterborough Arena and Peterborough City Council. The event is organised by Cambridgeshire Chambers of Commerce and The Business Club.

Business Focus takes place at Peterborough Arena, East of England Showground, Peterborough, PE2 6XE, on Wednesday 17 October, 9.00am-5.00pm. Entry for visitors is free on the day.

For further information, visit www.businessfocus.uk.net or call 01733 513002. Business Focus can also be found at www.facebook.com/BizFocus2012 and on Twitter #BizFocus2012

St Ives, Cambridgshire, UK

St Ives, Cambridgeshire PE27 5BH, UK

Saturday, 22 September 2012

Why see a financial adviser?

Labels:

critical illness,

Ewing Associates,

financial advice,

financial advisor,

FSA,

Infographic,

life insurance,

protection,

trust

St Ives, Cambridgshire, UK

St Ives, Cambridgeshire PE27 5BH, UK

Tuesday, 11 September 2012

As a company director, is your life insurance as tax efficient as it could be?

Relevant life policies are a type of life insurance for employers to provide employees with death benefits.

They can be very useful when there aren’t enough employees to justify a group scheme or, where an individual requires a greater level of benefit than the group scheme provides. As directors working day to day in a business are likely to qualify as employees, this can be a more tax efficient way for a company director to provide life assurance benefits for his/her dependants rather than paying for it personally or it being treated as a benefit in kind.

They can be very useful when there aren’t enough employees to justify a group scheme or, where an individual requires a greater level of benefit than the group scheme provides. As directors working day to day in a business are likely to qualify as employees, this can be a more tax efficient way for a company director to provide life assurance benefits for his/her dependants rather than paying for it personally or it being treated as a benefit in kind.

An example of relevant life insurance and its tax efficiency:

Mrs Anne Other is a shareholding director of A.Other Ltd, an engineering business, and currently has life insurance in place. She wishes to review her insurance as she and her partner are expecting their third child and they would like more cover.

Comparing the two plans that her financial adviser recommends, Anne doesn't hesitate to choose the Relevant Life plan. Below you can see the sums that made her decision easy.

The Relevant Life Plan is particularly beneficial for Anne because she’s the director and shareholder of her own business, so all the savings go to her. If she were to pay for her life cover personally it would cost her £1,569.65 every year. By buying her cover through the company using a Relevant Life Plan, it only costs £800 each year. That’s £769.65 less, which is a saving of almost 50%.

(This is a fictitious example, and also assumes that the Relevant Life plan qualifies as an allowable business expense, which it usually is)

What makes this plan so good for company directors?

- You can effectively make a big saving on life cover compared with paying for it personally.

- Premiums are normally classed as a business expense and so are likely to be an allowable deduction for Corporation Tax purposes.

- Premiums and benefits do not count towards your annual or lifetime allowance – particularly important if you have a large pension fund or wish to maximise your contributions into your pension.

- Keeping the plan in trust offers the potential to plan for Inheritance Tax if your estate is or is likely to be worth more than the current Inheritance Tax threshold.

- Offers a cost-effective way to provide Death In Service benefits to your employees.

Any limitations or drawbacks?

Relevant Life Plans are not available for sole traders, equity partners of a partnership or equity members of a Limited Liability Partnership.

It’s a Single Life Policy, which means each plan covers one person – you, for example.

There’s no option to include joint cover, such as for you and your partner, in the same policy.

There’s no option to include joint cover, such as for you and your partner, in the same policy.

How do I take advantage of a Relevant Life plan?

Speak to your financial adviser who should be able to discuss the features in more detail.

Labels:

business protection,

Ewing Associates,

financial advice,

financial advisor,

inheritance tax,

life insurance,

protection,

relevant life,

trust

St Ives, Cambridgshire, UK

St Ives, Cambridgeshire PE27 5BH, UK

Wednesday, 5 September 2012

The financial regulator wants a change to the way financial products are sold. A reaction to Martin Wheatley's speech.

In a speech published today, the Managing Director of the FSA, Martin Wheatley says he intends to change the culture of how consumers are viewed and sold to by some financial organisations.

This follows the recent PPI and loan mis-selling scandals, as well as other ativities which have tarnished the public's view of the financial services industry, such as Libor abuse and the mis-selling of interest rate products to small businesses.

Mr Wheatley goes on to say:

Although Mr Wheatley's focus appears to be on the non-advised arena that consumers will most likely encounter on the web and along the high street, the ideas he presents are high-level and therefore rather general. At this stage it's difficult to ascertain whether protection products such as life insurance, critical illness, and income protection will ultimately be affected by these plans. If they are, then it's important to get the balance right between protecting consumers from unscrupulous salespeople and not hindering, but rather improving accessibility to and awareness of good financial advice.

If advisers were no longer allowed to be remunerated by providers of protection products this would inevitably lead to a fee-based system similar to that for investment advice following changes brought about by the Retail Distribution Review (RDR). The problem with this approach for protection, is that few consumers actively seek protection advice. I suspect even fewer would be willing to pay a fee for it, especially if protection and life insurance can still be bought on a non-advised basis direct from providers over the internet, for example.

If we did reach such a situation it would likely lead to more consumers buying cover which may not be best suited to their needs (e.g. paying more for level term when only decreasing mortgage protection is required; creating a potential inheritance tax issue; not correctly assessing what sums insured are needed for family protection; not writing policies in trust and thereby failing to avoid probate delays). Or, worse still, we could see more people not taking out any cover at all and leaving their families unprotected because of a public perception that advice is too costly.

What I think is key to improving the service which consumers receive, is that non-advised selling of protection products should cease. This would ensure that all protection customers have received advice on what is right for their present circumstances. Every policy written should have evidence of its suitability for each particular client, including less/more expensive alternatives that were available yet not appropriate, features which were included/excluded and why they were/weren't right for the client.

This would result in the best of both worlds for consumers: no fee means a similar proportion as at present would still perceive financial protection as an accessible and affordable avenue to explore; and offering protection on an advised-only basis minimises the opportunity for mis-selling (due to current methods of quality monitoring) as well as providing all the added benefits of the advice process.

Let's hope, for the sake of consumers and their families, the FCA see things from a similar perspective.

But what is also still clear is that we need financial services more than ever. Most of us need to save more for our retirements, but many are not doing enough. And all of us need a strong, profitable financial services industry that can give us the advice we need to guide us, that can help to protect us from the unforeseen, and that can deliver the products that will help us achieve our life goals.I completely agree with this; it not only explains why the industry needs to be ethical, but also any business which correctly identifies and plugs such gaps in people's lives will be contributing to their own long-term success by doing so. But what does concern me is how the FSA or the FCA might further restrict the ways in which good quality, relationship-based financial advisers can operate, potentially resulting in fewer people receiving important financial advice.

Although Mr Wheatley's focus appears to be on the non-advised arena that consumers will most likely encounter on the web and along the high street, the ideas he presents are high-level and therefore rather general. At this stage it's difficult to ascertain whether protection products such as life insurance, critical illness, and income protection will ultimately be affected by these plans. If they are, then it's important to get the balance right between protecting consumers from unscrupulous salespeople and not hindering, but rather improving accessibility to and awareness of good financial advice.

Pricing Customers Out

If advisers were no longer allowed to be remunerated by providers of protection products this would inevitably lead to a fee-based system similar to that for investment advice following changes brought about by the Retail Distribution Review (RDR). The problem with this approach for protection, is that few consumers actively seek protection advice. I suspect even fewer would be willing to pay a fee for it, especially if protection and life insurance can still be bought on a non-advised basis direct from providers over the internet, for example.

If we did reach such a situation it would likely lead to more consumers buying cover which may not be best suited to their needs (e.g. paying more for level term when only decreasing mortgage protection is required; creating a potential inheritance tax issue; not correctly assessing what sums insured are needed for family protection; not writing policies in trust and thereby failing to avoid probate delays). Or, worse still, we could see more people not taking out any cover at all and leaving their families unprotected because of a public perception that advice is too costly.

The Best of Both Worlds

To ensure protection customers continue to receive the best outcome, I believe that insurance providers should continue to pay advisers for finding their clients. This way, advice and recommendations can still be offered with no fee required from the customer. Upfront fees would no doubt alienate a large proportion of the public who might otherwise have benefited from protection.What I think is key to improving the service which consumers receive, is that non-advised selling of protection products should cease. This would ensure that all protection customers have received advice on what is right for their present circumstances. Every policy written should have evidence of its suitability for each particular client, including less/more expensive alternatives that were available yet not appropriate, features which were included/excluded and why they were/weren't right for the client.

This would result in the best of both worlds for consumers: no fee means a similar proportion as at present would still perceive financial protection as an accessible and affordable avenue to explore; and offering protection on an advised-only basis minimises the opportunity for mis-selling (due to current methods of quality monitoring) as well as providing all the added benefits of the advice process.

Let's hope, for the sake of consumers and their families, the FCA see things from a similar perspective.

Labels:

business protection,

commission,

critical illness,

Ewing Associates,

FCA,

financial advice,

financial advisor,

FSA,

incentives,

inheritance tax,

keyperson insurance,

life insurance,

Martin Wheatley,

regulator

St Ives, Cambridgshire, UK

St Ives, Cambridgeshire PE27 5BH, UK

Wednesday, 29 August 2012

Trusts. What are they, and why use them for insurance?

It's often said that less than 10% of life insurance policies are written in trust. Although not all policies are suitable for writing in trust, this still leaves a large number of policyholders who haven't taken advantage of this simple option.

In this post, I'll explain what a trust is, the benefit of putting one in place, and question why more policies aren't in trust.

What exactly is a trust?

A trust is a relationship recognised by law whereby something is held by one party for the benefit of another. In respect of life insurance, there are normally three parties involved: the settlor (the policyholder); the trustee/s (the person/s to whom the insurance company will pay a claim); and the beneficiary/ies (the ultimate recipient of the money as intended by the policyholder). This may sound complex, in fact they are anything but: they simply allow someone to pass property on to another person at some point in the future.Why write life insurance in trust?

There are several reasons to write life insurance in trust.- Avoid probate delays. Probate is the legal process which must be completed before your estate can be distributed. This can take anything from a couple of months up to a year, and beyond in some cases. Probate delays can present a problem if an insurer has paid money into your estate and your family requires it sooner rather than later.

- Reduce an inheritance tax (IHT) bill. Benefit payed from a life insurance policy written in trust can be paid outside of your estate for IHT purposes.

- A trust enables you to choose your beneficiaries, thereby remaining in control of your assets.

- Being a simple process (often no more than a one page form), it is normally free of charge set up a trust.

So, why don't more people have one?

Most people I speak to who haven't written their life policy in trust simply weren't aware of trusts and their benefits. With people buying policies over the internet or from direct insurers on a non-advised basis, it may be some time before people are fully aware of their benefits.Check your existing policies.

If you have a life insurance policy, and are not sure whether it is written in trust or not, it is worth checking. You can do this by asking your insurer or speak to a financial adviser.Monday, 27 August 2012

Could you cope financially if you were diagnosed with a serious illness?

Some things are more reliable than others - monthly bills, for example. Young or old,

single or married, we all have financial obligations to meet each month; be it luxuries, like a satellite TV subscription or mobile phone contract, or the real essentials – like keeping a roof over your family's head.

But some things - like our long-term health - can be less reliable. More than 1 in 3 people in the UK will develop some form of cancer during their lifetime, according to Cancer Research UK.

If you became critically ill and were unable to work, those monthly expenses would still need to be covered if you wanted to maintain your lifestyle. Ask yourself:

could you cope financially?

Better protecting your finances

An important part of financial planning is to ensure your protection arrangements remain appropriate for your needs. Many people take out life insurance which provides valuable cover and and is designed to pay out in the unfortunate event of your death. But by taking out Critical Illness Insurance, you could receive a tax-free lump sum or monthly income should you suffer a serious illness or a major injury. This could help towards paying off your mortgage, meeting monthly household bills, covering additional medical expenses, reducing the financial impact if you were unable to return to work - or anything else you might chose to spend it on.Insurance premiums set to increase

Now is also a great time to review your protection needs. At the end of this year, new legislation will require insurance companies to ignore an individual’s gender when calculating premiums. This is expected to result in price rises for men and women in most cases – including for critical illness insurance. It’s therefore important you check your current financial protection needs before this change takes effect. The pricing changes may well lead to a rush of applications to insurance companies in the latter part of this year therefore contact your financial adviser now to help prevent you being caught out by this.Act now to ensure you are financially protected

To ensure you and your family are financially protected, and to beat any price increases, it would be prudent to review your protection needs at the earliest opportunity. I have found that people tend to put off taking out insurance, as we all have seemingly more urgent, and sometimes more interesting things that need doing. And that is completely understandable. So, while the intention is in your mind, why not pick up the phone now, call your financial adviser, and ask for a protection review.

St Ives, Cambridgshire, UK

St Ives, Cambridgeshire PE27 5BH, UK

Saturday, 25 August 2012

Losing sight of everyday threats could put your business at risk

If you are a business owner or a director, you are no doubt working harder than ever to

steer the company through this difficult trading period. As result,

your thoughts may be more focussed on the short-term needs of the company more than usual.

But

it’s more important now that you don’t lose sight of the

ongoing threats to your business – threats that could have an

impact as severe as any market downturn.

Protecting your most important assets

If

a director, co-owner or key individual within your business were to

die, or become critically ill, it could have a serious impact on your

company’s ability to trade. For instance:

- How would the loss of their expertise and experience impact the business?

- If they are a shareholder, what would happen to their shares? Could the business afford to buy them back?

- How would your debtors and creditors react? Would loans be called in?

You

probably already protect your company’s material assets, like

premises, vehicles and equipment. Surely it makes sense to also

protect the company’s most important assets – its people.

How you can obtain help

Some financial advisers often work with businesses offering advice on how best to

protect them from the financial impact of unforeseen events.

There is a range of products that can give you peace of mind

when it comes to the long-term stability of your business.

If it has been several years since, or if you have never conducted a review of your business's protection requirements, it would be a good idea to find a financial adviser who specialises in this area for an appointment. Don't leave your business unprotected until it is too late.

Labels:

business protection,

Ewing Associates,

financial advisor,

keyperson insurance,

life insurance,

protection,

shareholder protection

St Ives, Cambridgshire, UK

9 Station Rd, Saint Ives, Cambridgeshire PE27, UK

Friday, 24 August 2012

Life Insurance Premiums Expected to Rise

From 21 December 2012, changes to the EU Gender Directive will

mean insurers will no longer be able to use gender as an underwriting

factor when setting premium rates. This change will affect all types of

personal insurance with life, motor and annuities being among the most

significant.

It's sensible to ask your financial adviser for a review of your protection needs before the end of September, as in most cases, life insurance for both men and women will increase (significantly for some) from December. Those who take out a policy before the Gender Directive, will lock in their premiums at this year's prices. Waiting until next year could cost women 22% more for term life insurance, as a compounding factor is also a change to the "I minus E" rule.

From 1 January 2013, life companies will no longer be able to offset the costs of selling life insurance against investment income. This is known as the Income minus Expenses or “I minus E” rule, which many life companies use to subsidise their protection premium rates. As a result, premiums could increase by approximately 10% to compensate.

The perfect storm of gender neutral pricing and I-E will result in life rates rising for the majority, with insurers likely to wrap up rate changes to cater for both gender and I-E together.

It's sensible to ask your financial adviser for a review of your protection needs before the end of September, as in most cases, life insurance for both men and women will increase (significantly for some) from December. Those who take out a policy before the Gender Directive, will lock in their premiums at this year's prices. Waiting until next year could cost women 22% more for term life insurance, as a compounding factor is also a change to the "I minus E" rule.

From 1 January 2013, life companies will no longer be able to offset the costs of selling life insurance against investment income. This is known as the Income minus Expenses or “I minus E” rule, which many life companies use to subsidise their protection premium rates. As a result, premiums could increase by approximately 10% to compensate.

The perfect storm of gender neutral pricing and I-E will result in life rates rising for the majority, with insurers likely to wrap up rate changes to cater for both gender and I-E together.

Top Tips

- Speak to a specialist adviser now. You need to allow enough time for underwriting, as you will need to be accepted on cover before the 21 December. In some cases underwriting can take several months, so make sure you speak to a good financial adviser, or a specialist protection adviser as soon as possible.

- Tell others you know who have gone through a life change recently (e.g. marriage, divorce, birth of a child, mortgage) to ask an adviser to review their insurance as soon as possible.

St Ives, Cambridgshire, UK

St Ives, Cambridgeshire PE27 5BH, UK

Subscribe to:

Comments (Atom)